Area of Focus

- International VAT Refunds

- Mineral and Oil Tax Refund

- US Mobile Roaming Charge Refund

- Import Tax Refund

- Aviation Tax Refund

- Telecommunication Tax Refund

- Tour Operator Tax Refund

- Registration and Compliance

Overview

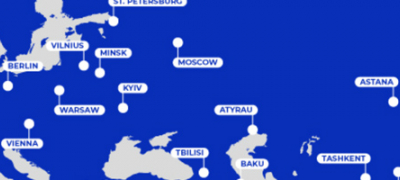

VAT IT specialises in identifying, researching and perfecting foreign Tax refund opportunities for our clients. Our core service offering is Value Added Tax (VAT) refunds for foreign corporations transacting in the European Union (EU), Australia, Japan & the Gulf States. Throughout the EU and elsewhere, Value Added Tax (VAT) is charged on various transactions. This includes your stay at a hotel, rental of exhibition space, services or supplies provided by suppliers and the importation of goods to name but a few. Foreign businesses are entitled to a refund of this Value Added Tax (VAT).

Team

Russell Grevler

Global Director, Business Development, VAT IT

Disclaimer: The information provided in this directory is sourced from third parties or has been provided by the entities listed herein. We do not guarantee the accuracy of this information and strongly advise users to verify the details before engaging with any of the listed entities for services. We are not involved in the delivery of the services nor are we a party to any transactions between users and the listed entities. All copyrights and trademarks associated with the listed entities are owned by their respective holders. Use this directory at your own discretion and risk.